Because we are one of the few countries that offer a 30 year fixed rate mortgage, it only makes sense to cover that mortgage with a 30 year level term life insurance policy. 25 year old smoking male, 500k in coverage with a 30 year term.

Permanent life insurance, on the other hand, has no expiration date.

Life insurance 30 year term. What does 30 year term life insurance mean? Since coverage will continue for 30 years, the majority of insurance companies will not issue a policy to an applicant over age 50. A 30 year term life policy is the longest term length available for a life insurance policy.30 year term policies will also cost more every month compared to shorter terms.

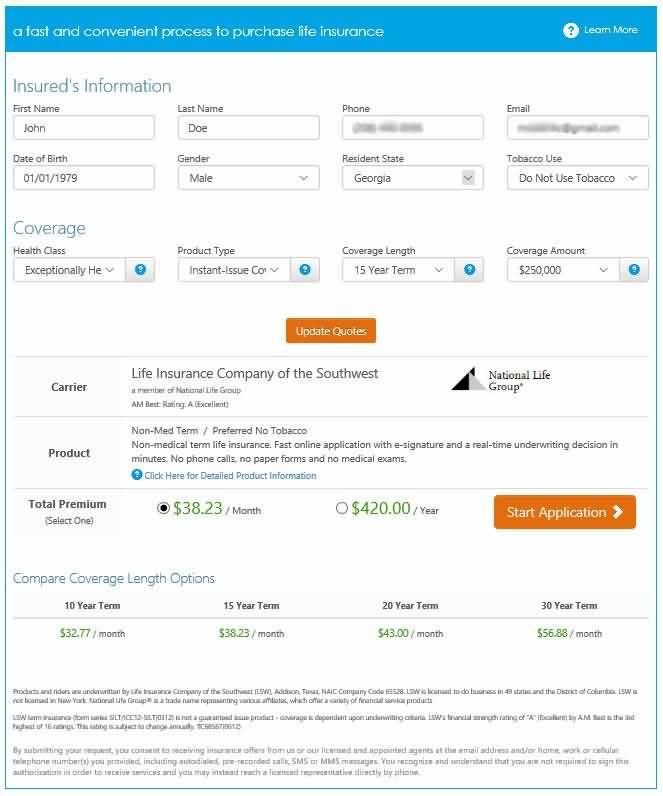

As we all know, health deteriorates with age. 30 year term life insurance 👪 nov 2021. Well, in a nutshell, people purchase 30 year term life insurance with level coverage to keep premiums fixed over a 30 year period.

In most cases, you cannot purchase term life for more than 30 years. Life insurance rates for people in their 30s. There is less of a chance the insurance company has to pay out the death benefit in 10 years vs 15 years vs 20 years vs 25 years vs 30 years.

However, your age will be much higher at that point, and your rates will typically increase. This is due to the fact that there is less risk for the insurance company. Homeownership, retirement, helping the kids pack up their hoverboards before you send them off to college.

Life auto home health business renter disability commercial auto long term care annuity. 25 year old smoking male, 500k in coverage with a 30 year term. Level term life simply means the rate is fixed for the term you select.

Term life insurance is a type of life insurance which provides a fixed amount of coverage for a fixed amount of years. Many people like the 30 year term because it covers a typical mortgage on their home residence and because historically, it was the longest term offered. Explore 30 year term life insurance from fidelity life.

You either have to do without or get another policy. Probably the most obvious answer on who should buy a 30 year term life policy is a homeowner. It is commonly purchased by canadians between the ages of 20 and 55.

But if you outlive the. 30 year term life insurance is available for those 55 and under. And, the average cost goes up less than 10 bucks by the time you reach 39 years old.

Term life insurance, as opposed to permanent, is a type of life insurance that is only valid for a specific number of years, or term. If you die during the term, your beneficiaries will receive a guaranteed death benefit. You can set up the death benefit life insurance settlement option to provide an annual income instead of a lump sum.

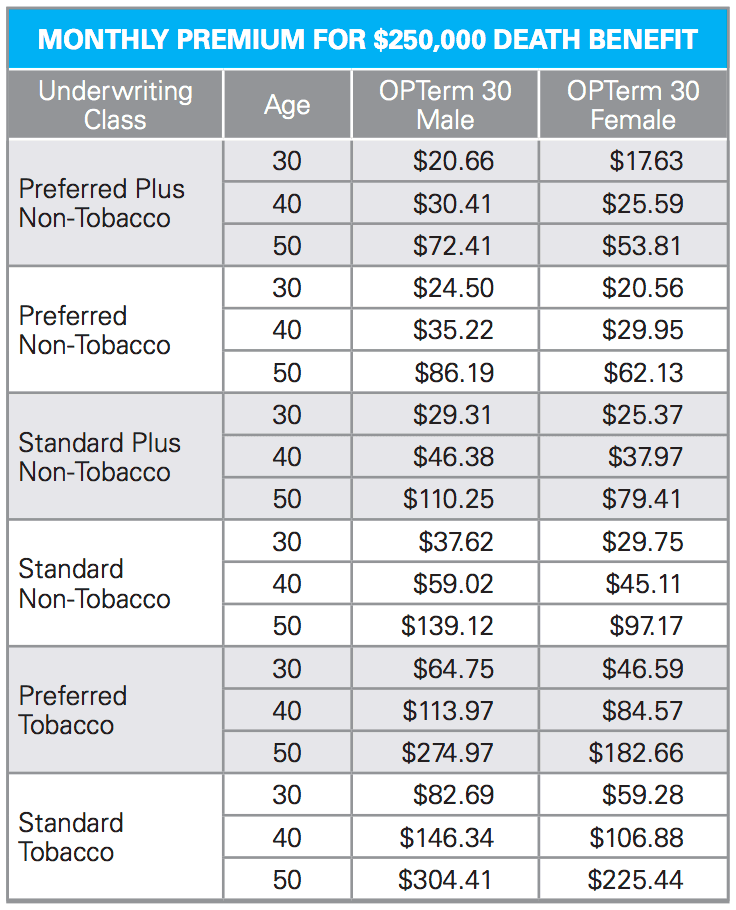

What is a 30 year term life insurance policy? It offers coverage for 30 years, and the premiums stay the same for the life of the policy. Rates for top health class.

Who should buy 30 year term life insurance homeowners. Fidelity life offers several 30 year term life insurance policies. Rapidecision® life 30 year term may work for individuals between the ages of 18 and 65 looking for coverage amounts between $50,000 and.

30 year term life insurance is a type of term life insurance available in canada. As you can see, if your lifestyle is unhealthy it can really hurt you when it comes to your life insurance premiums. Ad affordable, flexible term life insurance at your pace.

As you get older, the cost to insure yourself increases, but if you select a 30 year level term you pay the average premium for those 30 years. A 30 year term life policy provides the longest duration of coverage for a term life policy and decades of peace of mind. Permanent life insurance, on the other hand, has no expiration date.

It cannot be purchased after the age of 55. Since most companies won’t offer you a 30 year term life insurance policy if you are over 50, it’s best to get covered when you are younger. Rates current as of 9/29/2021.

Unlike a permanent life insurance policy like whole life, term life is for “if” you die in an allotted time the death benefit will be paid out. Because we are one of the few countries that offer a 30 year fixed rate mortgage, it only makes sense to cover that mortgage with a 30 year level term life insurance policy. How much life insurance does someone in their 40s need?

The general rule of thumb many financial advisors follow is to carry at least 7x to 10x your annual income in life insurance. However, 40 year term life insurance coverage is now available for applicants up to age 45. What does that have to do with life insurance?

The shorter the term the lower the price. Young and married with children Ad affordable, flexible term life insurance at your pace.

When the term of your life insurance policy expires, so does your life insurance benefit.