A higher pe ratio means that investors are paying more for each unit of net income, making it more expensive to purchase than a stock with a lower p/e ratio. A higher p/e ratio means you are paying more to purchase a share of the company’s earnings.

If investors are comfortable paying a higher price for shares, then that could reflect strong profits or expectations of high profits.

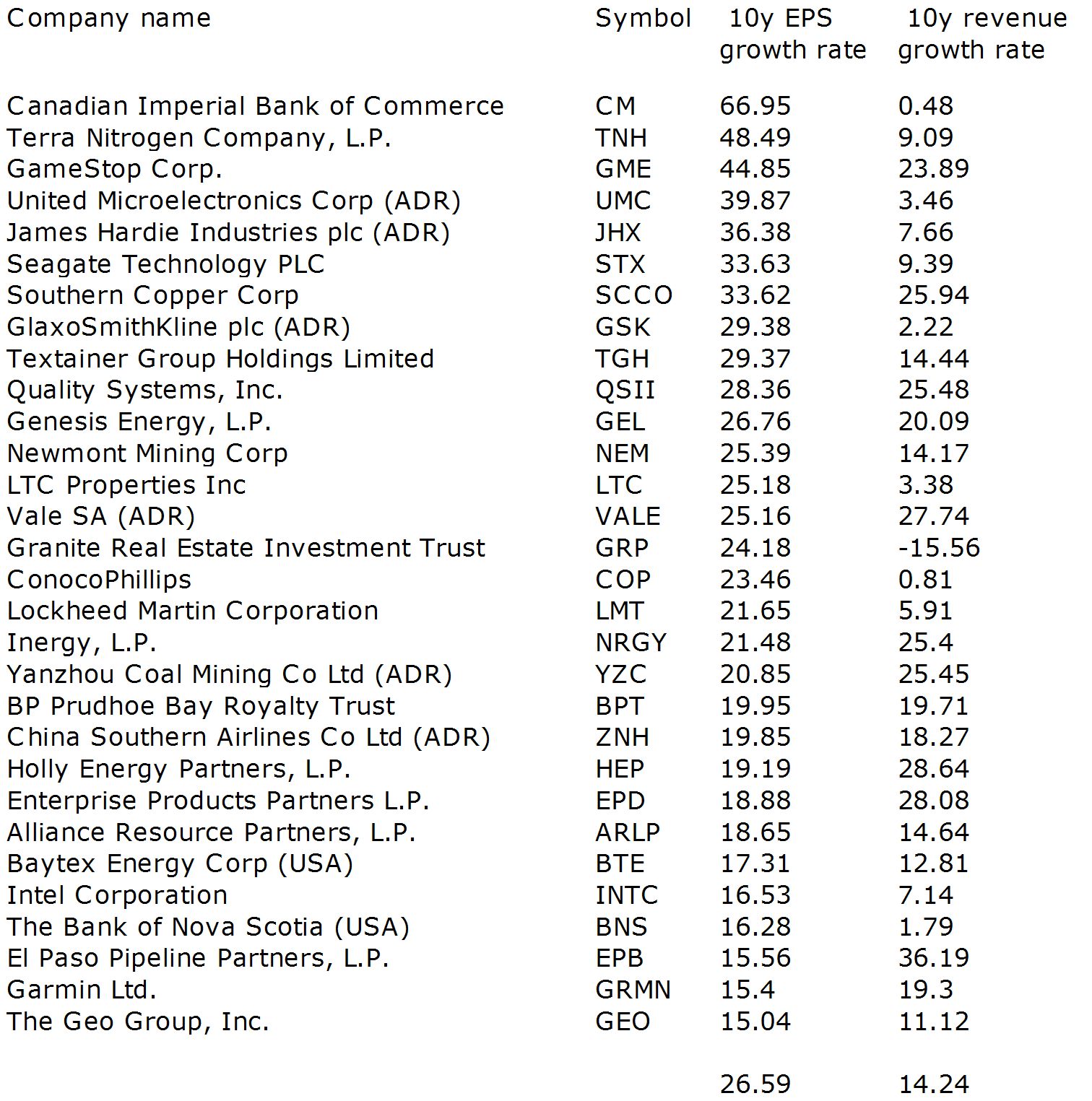

High earnings per share stocks. In the table below, you may see the stocks with highest reported p/e (price earnings) ratio which is defined as the ratio of total market capital value over earnings. These stocks have shown more than 20 percent growth in earnings per share in the most recent quarter compared to the same quarter a year ago, and have seen earnings increase in five of. One such shares which is having higher eps is mrf tyres.

Earnings yield is defined as earnings per share (eps) divided by the stock price. A higher p/e ratio means you are paying more to purchase a share of the company’s earnings. The higher the p/e ratio, the more you are paying for each dollar of earnings.

Understanding the price to earnings ratio. 103 rows a stock�s pe ratio is calculated by taking its share price and divided by its annual earnings per share. Net income after tax/total number of outstanding shares

In theory, a higher eps would suggest. A company with strong earnings per share might see the market price of its stock rise. While comparing similar stocks, the one with higher earnings yield has the potential of providing comparatively.

What is earnings per share (eps)? A high p/e ratio could mean that a company�s stock is. If a company has high earnings per share, investors perceive them to be.

Contact us already a member? Asx reported 0.99 in eps earnings per share for its first fiscal semester of 2021. So, what is a good pe ratio for a stock?

Earnings per share can be calculated in two ways: A higher pe ratio means that investors are paying more for each unit of net income, making it more expensive to purchase than a stock with a lower p/e ratio. The higher the earnings per share of a company, the better is its profitability.

Earnings per share represents the portion of a company�s profit allocated to each outstanding share of common stock. While earnings are a company’s revenue minus operation expenses, earnings per share are the earnings remaining for shareholders divided by the number of outstanding shares. Trading economics members can view, download and compare data from nearly 200 countries, including more than 20 million economic indicators, exchange rates, government bond yields, stock indexes and commodity prices.

Doing so could boost the company’s fiscal 2023 earnings per share by an additional $1, per his math. It�s calculated by the net income (reported or estimated) for a. Earnings per share (eps) indicates the financial health of a company.

If investors are comfortable paying a higher price for shares, then that could reflect strong profits or expectations of high profits. What does a high eps tell us? Mrf has created value for its shareholders.

This ratio is used by investors to compare companies and find undervalued stocks. Few things in the investment world operate in a vacuum and stock price and eps are not exceptions. Earnings yield is calculated as (annual earnings per share/market price) x 100.

You can explore more such stocks by browsing through the list given below. Then there’s the possibility that dell. While calculating the eps, it is advisable to use the weighted ratio, as the number of shares outstanding can change over time.

In theory, a higher eps would suggest that a company is more valuable. Earnings growth looks solid for emr for this fiscal year. The eps ratio uses net profits for calculations and, in a nutshell, it tells investors at a glance how much money a company makes per share of stock issued.

Meritage homes beat the zacks consensus estimate for earnings in the last. This higher stock price might create a positive impression of the company�s products in the minds of customers, resulting in greater demand. The zacks consensus estimate for 2021 is $4.91 per share, with earnings expected to.

Currently mrf is having an eps of rs 2430. Wbc) forecasted eps growth in. For example, if stock a is trading at $100 and it’s eps over the last twelve months is $10.00, then the yield of the stock is 10 percent (i.e., $10 / $100).

The eps ratio uses net profits for calculations and, in a nutshell, it tells investors at a glance how much money a company makes per share of stock issued. In general, if a company�s pe is equal $20 that means that investors are willing to pay $20 for $1 of earnings. This makes a high pe ratio bad for investors, strictly from a price to earnings perspective.